We recommend that you run the Internal Accounting Review (IAR) on a periodic basis throughout the year. That way, you can find and resolve issues regularly and not be overwhelmed at the end of the year. The Review is meant to be used to help you uncover common mistakes, but is not exhaustive.

There are two buttons on the toolbar:

- The Refresh button allows you to refresh or update the information in the Accounting Review after you've made changes.

- The Print Preview button allows you to look at the report before printing. To print an Internal Accounting Review report, you must first preview it.

Each time you open the Internal Accounting Review, the Review is run using the default reporting period of This Period. However, you can change the reporting period to one that suits your needs.

When you run the Internal Accounting Review for the first time, we limit the number of transactions displayed to 20 per check. If you want to display more or less transactions, you can change this limit at any time. You can choose to display up to 1000 transactions per check. If additional transactions are found that exceed your display limit, then you will receive a message at the end of the list of transactions that were found.

After you have run the Internal Accounting Review, we provide a visual summary of what the review has found. In addition to the summary, an indicator will be placed at the end of each check label. A red flag indicates that you need to review the items that have been uncovered. A green check mark indicates that no transactions were found for the check.

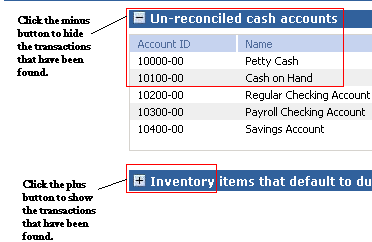

In the Internal Accounting Review window, you can choose to show or hide the contents of one or more checks. For example, if you are not interested in seeing the information for one of the checks, you can hide the information from the window view. Simply, click minus to hide and click plus to show.

For every transaction that is found by the Review, you will be able to go back to the original transaction or a report. This is called drilling down to transaction detail. To get to the transaction detail or report, click the transaction link. You will be taken to transaction detail or report, which allows to further investigate the transaction.

You can print two types of Internal Accounting Review (IAR) reports:

- one that lists all of the Internal Accounting Review checks

- one that lists one specific Internal Accounting Review check

To print a report that lists all IAR checks, click Print Preview. Then click Print to print the report.

To print a report that list one IAR check, right-click on the name of the IAR check that you want to print. Then, select Preview this check from the menu. Click the Print button to print the report.

For two of the IAR checks, you can select which accounts to include or exclude from the check. The checks that allow you to select which accounts to include are:

- Accounts receivable accounts that are out of balance with the aged receivables report

- Accounts payable accounts that are out of balance with the aged payables report

- To select accounts, click the plus button next to Select your Accounts Receivable/Payable account. The accounts will appear and you can select or clear any of the accounts. For example if you don't use one of the accounts, you should probably clear the check box.

- Click Apply to save your account selections.

In addition to all of the options that have been mentioned, the Internal Accounting Review also has a right-click menu. This menu contains two options:

- Select Refresh this page to update and reload all information in the Internal Accounting Review.

- Select Preview this Internal Account Review check to preview and print a specific check. For this menu option to be made available, right-click on the check name.